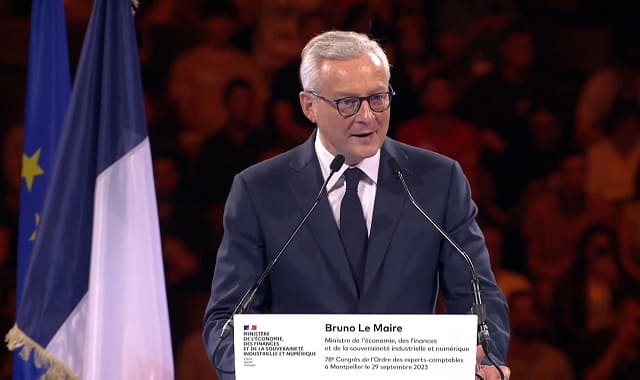

The Minister of the Economy, Finance and Industrial and Digital Sovereignty, Bruno Le Maire, clarified during the 78th Congress of the Order of Chartered Accountants, the new “3-stage calendar” envisaged for the generalization of electronic billing in France for businesses. After delivery of the Public Billing Portal (PPF), at the end of 2024, a test on a voluntary basis will be carried out in 2025, before definitive implementation of the reform from the year 2026. amendment to the finance bill for 2024, dated October 17, has just specified the September 2026 deadline for the obligation to receive for all and the obligation to issue for large companies and ETIs, and to September 2027 for the emission obligation for SMEs and VSEs. For the technical teams, the first challenge therefore consists of finalizing the migration from Chorus Pro to PPF, to be able to initiate the pilot phase and then start-up on time.

⚙ Learn more

During the 78th Congress of the Order of Chartered Accountants, held recently, the Minister of the Economy, Finance and Industrial and Digital Sovereignty, Bruno Le Maire, provided details regarding the new three-step action plan which aims to generalize electronic invoicing in France for businesses. This ambitious plan, focused on the modernization and simplification of processes, is intended to mark a major turning point in the world of accounting and financial management.

The first step in this initiative is to deliver the Public Billing Portal (PPF) by the end of 2024. This portal will serve as a cornerstone for the transformation of the billing system in France. It will provide businesses with a more efficient and sustainable way to manage their financial transactions. The PPF will be designed to meet the varied needs of businesses, whether large, medium or small.

After the implementation of the PPF, the year 2025 will be devoted to a voluntary pilot phase. Businesses will have the opportunity to test and adopt electronic invoicing at their own pace. This step will make it possible to collect important feedback, identify potential challenges and refine the system according to the specific needs of companies.

Finally, the last stage of this major transition will be the definitive implementation of the reform during the year 2026. An amendment to the finance bill for 2024, dated October 17, has just confirmed the deadline of September 2026 for the obligation to receive for all and the obligation to issue for large companies and ETIs, and of September 2027 for the obligation to issue for SMEs and VSEs. This step represents a significant change in the business world in France, with major implications for tax compliance and accounting management.

For the technical teams involved, the first challenge therefore consists of finalizing the migration from Chorus Pro to the PPF, to be able to initiate the pilot phase and then the start-up on time. This migration is of paramount importance to ensure the smooth transition to electronic invoicing at scale, providing businesses with the opportunity to adapt to new standards while optimizing their financial operations. This is a crucial step in the modernization of France in the context of digitalization and economic efficiency, positioning the country at the forefront of modern financial management.